Lease vs. Buy: Which One Saves You More on Taxes?

Should I lease or buy this vehicle or piece of equipment? Which option is better for taxes?

The focus here is on small corporate business owners, but the information may apply to your personal situation too.

Before diving into numbers, make sure whatever you’re buying is used primarily for business purposes. Why? Because there are tax implications if business assets are also used for personal purposes.

Breaking It Down with a Real Example

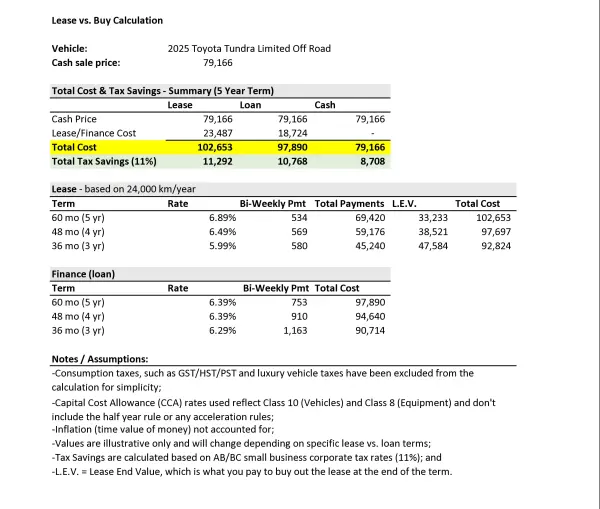

I got a term sheet from a local Toyota dealership. It’s for a 2025 Toyota Tundra Limited Off Road, listed at $79,166. The dealership offers financing options for both leasing (up to 5 years) and purchasing with a loan (up to 7 years). Let’s use this as our example to explore which option is more tax-efficient.

A quick summary of what the dealership provided:

- Bi-weekly payments (every two weeks).

- 24,000 km per year maximum allowed under the lease option.

- L.E.V. (Lease-End Value): This is the buyout price if you decide to purchase the vehicle after the lease ends. It’s also called the option purchase price.

Leasing vs. Buying: Which Costs More?

Based on my calculations, leasing will be the more expensive option.

- Lease for 5 years: Total payments = $102,653

- Loan for 5 years: Total payments = $97,890

These numbers assume you’ll buy out the lease at the end, so the total lease cost includes the Lease-End Value (L.E.V.).

The math is straightforward:

- For bi-weekly payments, you’ll have 26 payments per year (because there are 52 weeks in a year).

- Multiply the payment amount by 26 and then by the number of years the loan or lease is financed over.

For example:

- Loan: $753 bi-weekly payment × 26 × 5 years = $97,890.

- Lease: Add in the Lease-End Value to the total payments to get $102,653

Tax Savings: Lease vs. Loan

Here’s the interesting part—the tax savings under both options are very similar. With an 11% corporate tax rate, the savings are about $11,000 whether you lease or buy with a loan. However, there are some nuances to keep in mind:

- Lease Option: You can deduct the full lease payments each year (e.g., $13,884 annually).

- Loan Option: You can depreciate the asset over time (using a 30% depreciation rate for vehicles or 20% for equipment). You can also deduct the interest paid on the loan.

- Cash Purchase: If you pay cash, you won’t have interest to deduct, but you can still depreciate the asset over time.

While the deductions play out differently over the years, the total tax savings are comparable in the long run. However, with financing or a cash purchase, you get larger deductions in the early years, which may help if your business needs immediate tax relief.

Important Tax Rules to Consider

Tax savings depend on depreciation rules—known in Canada as Capital Cost Allowance (CCA). Here are some important rules:

- Half-Year Rule: In some cases, you can only claim half of the annual depreciation in the first year.

- Acceleration Rules: Some assets qualify for immediate expensing, meaning you can deduct the entire purchase cost in the year you buy it.

- Passenger Vehicle Limits: If the vehicle is considered a “passenger vehicle” (used less than 90% for business or not transporting goods), the maximum deduction is $36,000—even if the vehicle costs more.

For example, if you buy a $100,000 SUV but it doesn’t meet the business-use criteria, your total tax savings cap at $4,000, not the full $100,000.

What Else Should You Consider?

Choosing between leasing and buying isn’t just about tax savings. Here are other factors to keep in mind:

- How much can you afford?

- Is the purchase necessary? Will it grow your business or just drain cash?

- Are there used options? Used vehicles may come with higher repair costs but could offer significant savings.

- Opportunity Cost: If you have cash but also high-interest debt, it might be smarter to pay down that debt and finance the vehicle instead.

- Leasing Restrictions: Know what you’re committing to with a lease. How many kilometers can you drive? Are you responsible for minor damages?

I personally prefer buying over leasing because you own the asset. But if you like having a new vehicle every few years, leasing might make sense for you.

The Bottom Line

Here’s the key takeaway:

- You’ll save more taxes on the more expensive option, but tax savings alone don’t justify overpaying.

- If you need the vehicle or equipment for your business, buy it before your year-end to maximize the current year’s tax break.

- If you don’t need it, invest the money in your business or pay down debt instead.

Ultimately, the decision to lease or buy shouldn’t be based only on tax savings. The goal is to make the right financial decision for your business.

More Articles

5 Smart Tax Strategies for Canadian Business Owners

Incorporating your business, income splitting, and taking advantage of tax deferral and insurance benefits are key strategies to simplify and reduce your taxes.

Consequences of not filing taxes in Canada

Failing to file your taxes in Canada can result in penalties, interest, and loss of government benefits. The CRA may take action such as garnishing wages or placing liens on property. Filing as soon as possible and seeking professional help can help.